Results

Monthly Payment: $0.00

Total Payment: $0.00

Total Interest: $0.00

Loan Calculator Overview:

A loan calculator is a tool that enables users to estimate the monthly payment of loans on the basis of user provided information, such as credit amounts, annual interest rates and term. It provides users with information about the financial implications of a loan, including an amount for each month’s payment, cumulative payments over time and overall interest paid.

Formula:

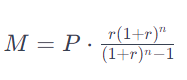

The formula used to calculate the monthly payment for a fixed-rate loan is based on the amortization formula:

Where:

- M is the monthly payment,

- P is the loan amount (principal),

- r is the monthly interest rate (annual rate divided by 12 and converted to a decimal),

- n is the total number of payments (loan term in months).

How to Use:

The amount of the loan Principal: Please specify the total amount of the loan that is to be considered. It’s the initial amount of the loan.

Annual Interest Rate: Input the annual interest rate associated with the credit facility. It represents the cost of borrowing in percentage terms.

Loan Term: Specify the length of the loan over a period of years. The duration of the loan will tell you how long to pay it back.

Calculate: To start calculating, click on the “Calculate” button.

Results: The calculator will show the month’s payment, the entire instalment over the term of the loan and its overall interest. In addition, the distribution of interest and principal payments is illustrated by a pie chart.

Important Notes:

Decimal Places: In order to be clear, the calculator typically shows results that are rounded to 2 digits.

Commas: For the sake of readability, commas are used to show a high number.

Interest Distribution: The proportion of interest and principal payments is visually shown in the pie chart.

Changing Inputs: You can see the effect on your payments by changing any input fields and calculating them.

Please note that this calculator gives estimates and the actual loan terms may change, for example due to factors like compound frequency or other charges. For accurate calculations, always refer to the specific terms and conditions laid down by your lender.